New Mountain Finance: Snapping Up a Bargain with a 13% Discount – Is Now the Time to Invest?

Is New Mountain Finance (NMFC) a Smart Pick for Income Investors?

In the ever-shifting landscape of investment opportunities, finding undervalued assets can feel like striking gold. New Mountain Finance Corporation (NMFC) is currently offering just that – a compelling 13% discount to its Net Asset Value (NAV). But is this discount a genuine opportunity, or a sign of underlying concerns? This article dives deep into NMFC, examining its strengths, risks, and ultimately, whether it’s a ‘Buy’ for those seeking passive income in the current market.

Understanding the Discount: What’s Driving It?

A 13% discount to NAV isn't something you see every day. It suggests the market might be undervaluing NMFC's assets. Several factors could be contributing to this. Macroeconomic uncertainty, rising interest rates, and general market volatility often lead investors to shy away from financial institutions, even those with solid fundamentals. Furthermore, the closed-end fund structure of NMFC can sometimes lead to discounts, as it doesn’t constantly issue and redeem shares like a mutual fund.

The Allure of Stable Credit and Income

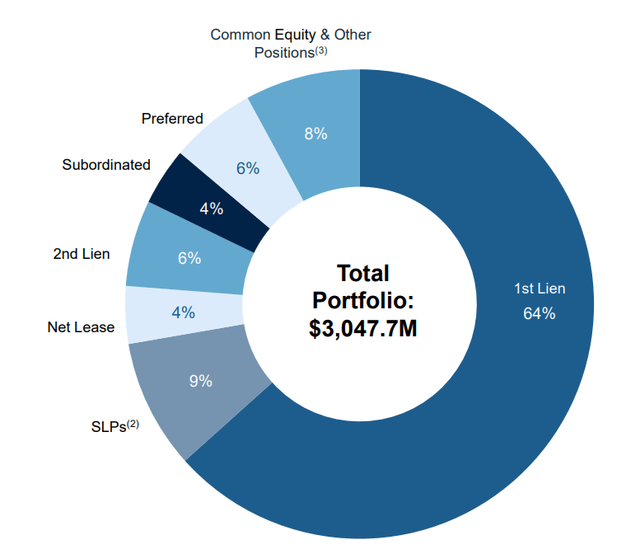

Despite the discount, NMFC boasts a key strength: a portfolio of high-quality, largely secured loans. This translates to relatively stable credit, a significant advantage in a potentially turbulent economic environment. The company focuses on providing financing solutions to middle-market companies, a sector often overlooked by larger lenders. This niche focus allows NMFC to build strong relationships and generate attractive returns.

NMFC distributes a consistent dividend, making it attractive to income-focused investors. However, it's crucial to acknowledge the inherent risks associated with dividend-paying companies, which we'll explore further below.

The Elephant in the Room: Dividend Risk

While the dividend is a major draw, it also presents the most significant risk. NMFC’s dividend payout ratio is relatively high, meaning a larger portion of its earnings is distributed as dividends. While this is great for income, it leaves less room for error if loan losses increase or investment performance falters. Rising interest rates can also impact profitability and, consequently, the sustainability of the dividend.

Investors should carefully monitor NMFC’s earnings and asset quality to assess the long-term viability of the dividend. A potential slowdown in the economy could lead to increased defaults and pressure on earnings, potentially forcing the company to reduce or suspend its dividend.

Key Considerations for Potential Investors

- NAV Discount: While attractive now, monitor how the discount evolves. A narrowing discount could boost returns, while a widening discount could signal further concerns.

- Credit Quality: Stay informed about the performance of NMFC’s loan portfolio.

- Dividend Sustainability: Assess the payout ratio and the company's ability to maintain dividend payments in various economic scenarios.

- Interest Rate Sensitivity: Understand how rising interest rates could impact NMFC’s profitability and asset values.

The Verdict: A Calculated Risk?

New Mountain Finance presents a compelling opportunity for investors willing to accept a degree of risk. The 13% NAV discount is alluring, and the stable credit profile is reassuring. However, the elevated dividend risk requires careful consideration. Before investing, conduct thorough due diligence, understand your own risk tolerance, and consult with a financial advisor. For those seeking passive income and comfortable with the potential downsides, NMFC could be a worthwhile addition to a diversified portfolio.