Basel Medical Shares Plunge as $1B Bitcoin Deal Sparks Investor Concerns

Basel Medical's Bold Bitcoin Bet Sends Shares Tumbling

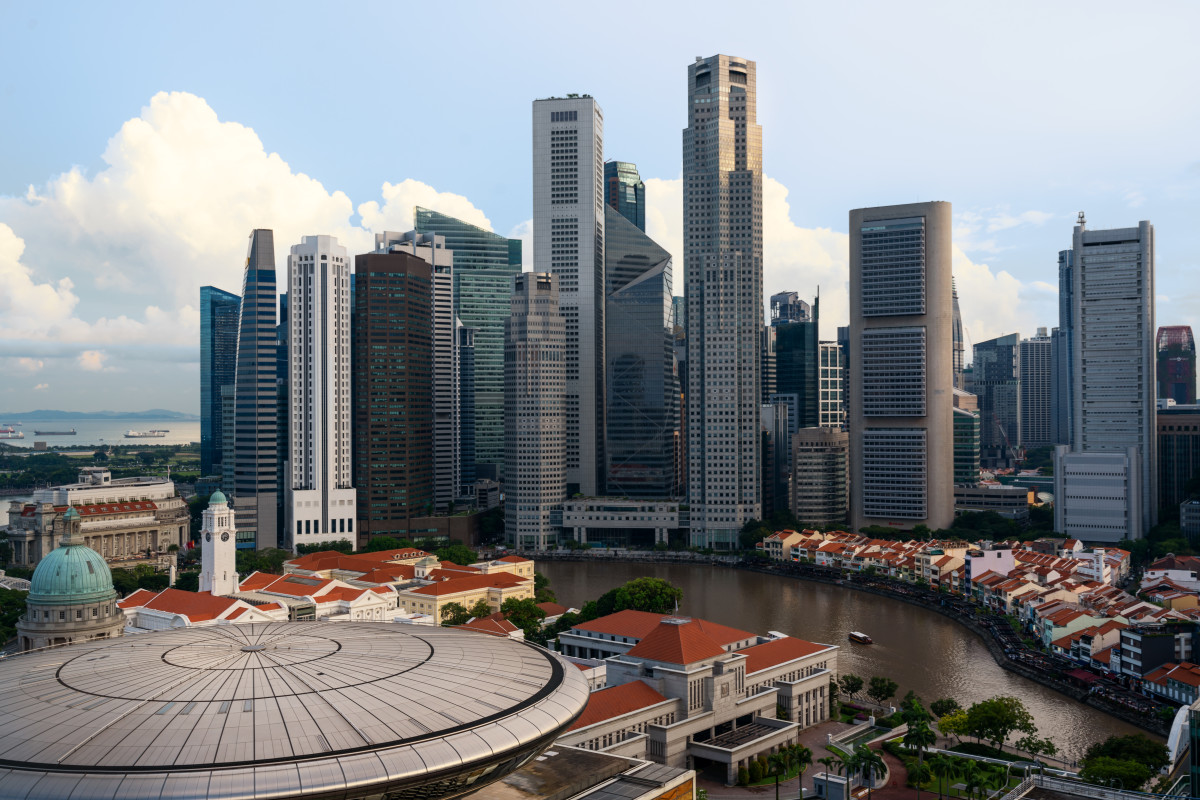

Singapore-based Basel Medical is making headlines, but not for the reasons it hoped. The healthcare company's shares took a significant hit after announcing a highly ambitious plan: a $1 billion deal involving Bitcoin, facilitated through a share swap, aimed at rapidly expanding its presence across Asia's booming healthcare markets. While the ambition is undeniable, the move has raised eyebrows and sparked investor concerns, leading to a sharp decline in the company's stock value.

The Ambitious Plan: Bitcoin for Healthcare Expansion

Basel Medical's strategy hinges on leveraging Bitcoin to fuel aggressive growth. The company intends to swap shares for Bitcoin, effectively securing a substantial war chest to invest in expanding its services and infrastructure throughout Asia. This expansion will focus on key areas within the healthcare sector, including diagnostics, medical technology, and patient care services. The rationale is that Bitcoin's potential as a store of value and its growing acceptance can provide a flexible and efficient funding mechanism compared to traditional financing options.

Why the Investor Concern?

The immediate market reaction suggests investors are wary of the plan's inherent risks. Several factors contribute to this unease:

- Bitcoin Volatility: Bitcoin's price is notoriously volatile. This inherent risk means Basel Medical's funding could fluctuate significantly, potentially impacting their expansion plans and overall financial stability.

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrency remains complex and evolving in many Asian countries. Uncertainty about future regulations could hinder Basel Medical's ability to operate effectively.

- Lack of Proven Track Record: While Basel Medical has demonstrated success in Singapore, expanding into diverse Asian markets presents unique challenges. Investors may question the company's ability to navigate these complexities successfully, especially with a high-stakes, unconventional funding strategy.

- Dilution of Shareholder Value: The share swap component of the deal could potentially dilute the value of existing shareholders' holdings, further contributing to the negative market sentiment.

The Potential Upside

Despite the current challenges, Basel Medical's plan isn't without potential benefits. If successful, the Bitcoin-fueled expansion could position the company as a leading player in Asia's rapidly growing healthcare market. The agility and efficiency of Bitcoin as a funding source could give Basel Medical a competitive edge. Furthermore, embracing blockchain technology could open up new avenues for innovation and improved healthcare delivery.

Looking Ahead

Basel Medical faces a critical juncture. The company needs to effectively communicate the rationale behind its Bitcoin strategy, address investor concerns, and demonstrate a clear plan for navigating the regulatory and market challenges. The success of this ambitious venture hinges on Basel Medical's ability to execute flawlessly and adapt to the ever-changing landscape of both healthcare and cryptocurrency.

The market will be closely watching Basel Medical's next moves, assessing whether this bold bet on Bitcoin will ultimately pay off or prove to be a costly misstep.